https://www.bloomberg.com/news/articles/2024-05-01/huge-fx-gains-are-japan-s-benefit-from-intervention-setser-says?embedded-checkout=true

Huge FX Gains Are Japan’s Benefit From Intervention, Setser Says

- CFR’s Setser sees ‘clear financial gains’ from intervention

- Latest BOJ data suggests officials stepped in to support yen

In this Article

The Japanese government can expect to have realized “windfall” profits if officials did indeed intervene in currency markets by selling dollars and buying yen on Monday, according to Brad Setser, a senior fellow at the Council on Foreign Relations.

That’s because Japan holds a large amount of foreign currency-denominated assets bought when the yen was much stronger compared to levels today. Assuming intervention took place, Setser said, at the simplest level the Japanese authorities followed the most fundamental of investing strategies: buy low and sell high.

“Reserves are unhedged foreign currency assets. The accounting of reserves is always complex, but there are clear financial gains,” Setser, a former Treasury Department economist, said in an interview. “It just so happens that some of the biggest windfall gains are sitting on the government balance sheet.”

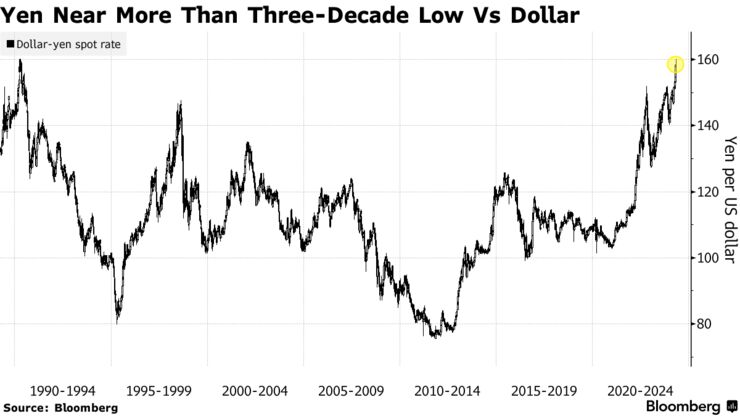

Japan likely conducted its first currency intervention since 2022 to prop up the yen on Monday, according to a Bloomberg analysis of central bank accounts. The yen surged back from its weakest level against the dollar in 34 years, in holiday-thinned trading.

Foreign-exchange reserves are assets denominated in other currencies held by a country as a defense fund that can be tapped in the case of economic or financial stress. While they gain or lose value as financial markets rise and fall, they are a finite resource that needs to be replenished when used.

In a separate post on social-media site X, previously known as Twitter, Setser estimated Monday that the Japanese government and its pension investment fund have bought around $1.2 trillion worth of dollars and euros since 2000.

“Japan issued yen to buy dollars back when you could get a dollar for 80 yen and now you can sell that dollar for 155,” Setser said. “Financially speaking, reserves have gone a lot up and so it makes sense to take some gains.”

Yen’s Meltdown and Rebound Are Just a Taste of What’s to Come

According to Bloomberg calculations, authorities spent some 5.5 trillion yen, or roughly $35 billion on Monday.

“It was on the high side of what I might have been expecting. It does imply they’re fighting the market and the market is really testing them,” Setser said. “The market will have to be convinced because the Japanese didn’t come in at 150 after a lot of talk. They waited until 160.”